The payment landscape in the UAE is rapidly evolving, as the instant payment system Aani gains popularity among residents. This innovative platform eliminates the need for cash or lengthy bank transfers, enabling users to send and receive money with ease. Aani facilitates transactions in seconds, whether it’s for splitting a bill with friends, sending money to family, or making purchases at local vendors.

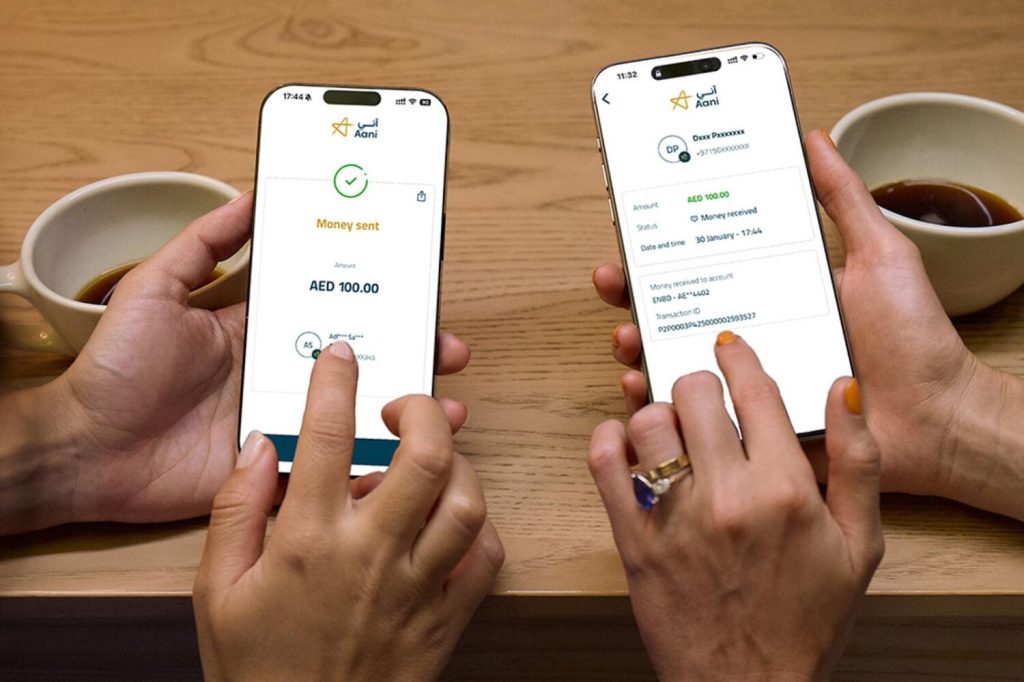

Aani allows users to send money instantly without needing long IBANs or complicated account numbers. Users can make transfers in under 10 seconds by simply using a mobile number, email, or QR code. This feature removes the hassle of memorizing account details or waiting for transactions to process. Whether paying rent, sending money to a friend, or settling a restaurant bill, Aani streamlines the process of sending money.

The platform also simplifies the process of requesting money. Aani’s ‘Request Payment’ feature allows users to send a payment request in just a few taps. By selecting a contact, entering the amount, and hitting ‘Request’, users can avoid awkward reminders. The recipient receives an instant notification and can approve the payment quickly, making it easier to settle shared expenses like rent or concert tickets.

Aani addresses the common issue of bill splitting, which can be stressful. With its Split Bill feature, users can send a request to their friends, who can then pay their share directly from their bank accounts or wallets. This eliminates the need for manual calculations and the hassle of chasing after payments later.

For those who prefer not to use cash or cards, Aani offers a QR code scanning feature for instant payments. Users can scan a QR code to transfer money instantly, making it practical for reimbursing friends or paying local vendors. The system is designed to be inclusive, providing digital payment options even for those without traditional bank accounts.

Additionally, Aani supports transactions between various bank accounts, digital wallets, and salary cards. This inclusivity ensures that everyone can engage in the digital economy, regardless of their banking situation. Aani can also be accessed through various banking apps, enhancing convenience for users.

The app allows users to manage multiple bank accounts in one place, streamlining the payment process. Instead of switching between different banking apps, users can select which account to use directly within Aani. This feature simplifies transactions and makes managing finances more efficient.

Aani also provides instant transaction confirmations, allowing users to know immediately when their payment has gone through. This real-time processing means there’s no need for users to check back later, bringing greater confidence and ease to every transaction.

With over one million users already registered, Aani has quickly become the preferred instant payment method in the UAE. The platform is not only convenient and user-friendly but also supports various lifestyles, from everyday transactions to business operations seeking a cashless future.

Leave a Reply