Businesses in the UAE face approaching deadlines for corporate tax registration, with the Federal Tax Authority (FTA) increasing its efforts to ensure compliance. The FTA has emphasized the importance for individuals subject to corporate tax to submit their registration applications by the end of March 2025. Failure to do so may result in violations of...

Tag: corporate tax

UAE’s Evolving Tax Culture Enhances Transparency and Investor Confidence

The United Arab Emirates (UAE) is witnessing a significant evolution in its tax culture, which is crucial for fostering a more sustainable and diversified economy. Analysts and tax experts emphasize that this shift will increase transparency and boost investor confidence. The corporate sector has quickly aligned itself with tax compliance due to effective awareness campaigns...

UAE Implements Key Changes in March 2025

March 2025 brings several important updates for UAE residents, freelancers, and commuters. These changes span traffic regulations, tax requirements, and utility billing, alongside developments in space technology. Starting today, the UAE’s updated traffic law lowers the legal driving age to 17 and includes e-bikes and e-scooters under traffic regulations. Stricter penalties for violations like drunk...

Changes in UAE Corporate Tax Reporting Raise Concerns for Businesses

The UAE has implemented a federal corporate tax with a standard rate of 9 percent, effective from the financial year commencing on or after June 1, 2023. This shift aims to enhance regulatory clarity, but recent alterations to reporting timelines have left many businesses scrambling to adapt. Recently, some companies in the UAE received notifications...

Sharjah Ruler Introduces New Corporate Tax Law for Natural Resources Companies

His Highness Sheikh Dr. Sultan bin Mohammed Al Qasimi, the Supreme Council Member and Ruler of Sharjah, has enacted a new law regarding corporate tax for both extractive and non-extractive natural resource companies operating in the Emirate of Sharjah. This law aims to establish clear tax obligations for companies involved in these sectors. Under this...

UAE Announces New Tax Incentives for Multinational Companies

The UAE has unveiled a set of tax incentives for multinational companies (MNCs) operating within the country. These measures, effective from January 1, 2025, are designed to encourage investment activities and strengthen the UAE’s position as a global business hub. MNC entities in the UAE will be subject to a corporate tax rate of 15%,...

FTA Reminds Natural Persons to Register for Corporate Tax Before March 31

The Federal Tax Authority (FTA) has called on natural persons conducting business in the UAE to register for Corporate Tax by March 31, 2025, to avoid penalties. The authority highlighted that failing to meet this deadline would result in an administrative fine of AED10,000. According to the FTA, a natural person, defined as any living...

UAE Imposes 14% Monthly Penalty for Unpaid Corporate Tax

The Federal Tax Authority (FTA) in the UAE has announced that corporations failing to pay their due corporate tax will incur a monthly penalty of 14 percent per annum. This penalty is applied to the unpaid tax amount and begins accruing from the day after the payment deadline. Each month following the deadline, the penalty...

UAE Businesses Face First Corporate Tax Deadlines and Penalties for Non-Payment

The UAE’s corporate tax system is now in full effect, and some businesses have already filed their first tax returns, marking a significant milestone since the country introduced the tax in June 2023. Companies licensed in June 2023, whose financial year ended by February 29, 2024, had until December 31, 2024, to submit their returns...

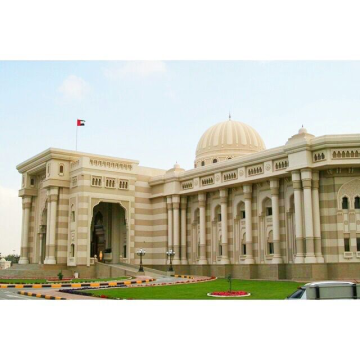

Sharjah Council to Review Draft Corporate Tax Law

The Sharjah Consultative Council will hold its seventh session this Thursday to discuss a draft law on corporate tax for natural resources in the emirate. The meeting will take place at the Council’s headquarters under the leadership of its Chairman, Dr. Abdullah Belhaif Al Nuaimi. The session will begin with the approval of the minutes...