Emaar Economic City has reported a staggering 348% surge in losses last year, primarily attributed to a decline in profits from residential real estate, industrial land, and commercial property sales. This information was highlighted in a report by Al-Eqtisadiah on March 27.

The company’s net losses reached SAR1.1 billion ($293.3 million) during the period, a sharp increase from SAR253 million ($67.5 million) in 2023. Additionally, Emaar Economic City’s revenues dropped significantly, falling to SAR426 million ($113.6 million), which represents a 59% year-on-year decline from over SAR1 billion.

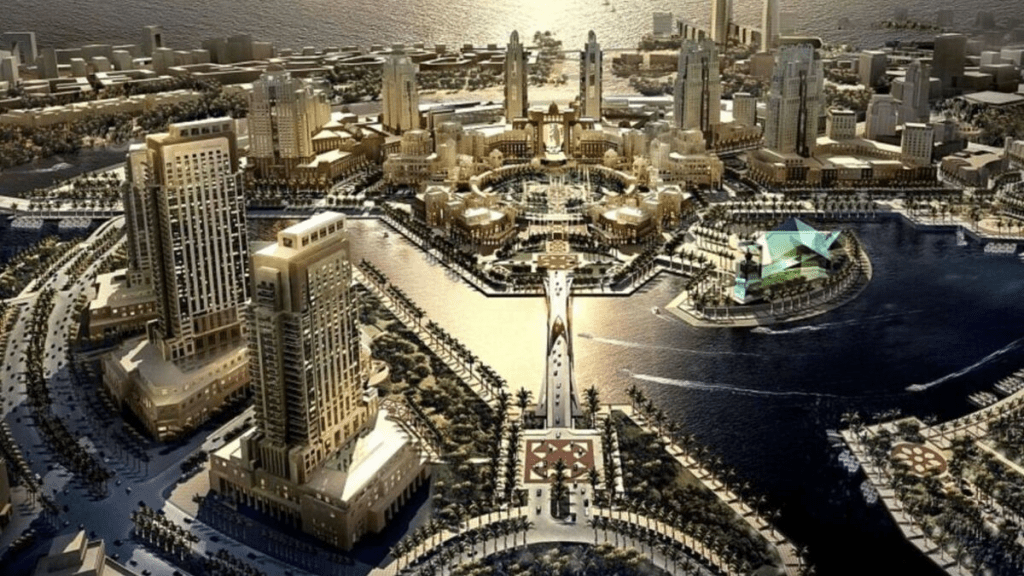

Established in 2006, Emaar Economic City is a Saudi joint stock company that has been listed on the Saudi Stock Exchange Tadawul since October 7, 2006. The company is tasked with the development of King Abdullah Economic City, which features an advanced port along the Red Sea coast and is strategically located within one hour’s travel from Jeddah, Mecca, and Medina, thanks to a newly developed network of roads and railways.

The Public Investment Fund holds a significant 25% stake in Emaar Economic City, while Dayim Modern Real Estate Management Company owns 11.912%. These major shareholders are instrumental in the company’s ongoing efforts to navigate the challenges currently facing the real estate market.

Leave a Reply