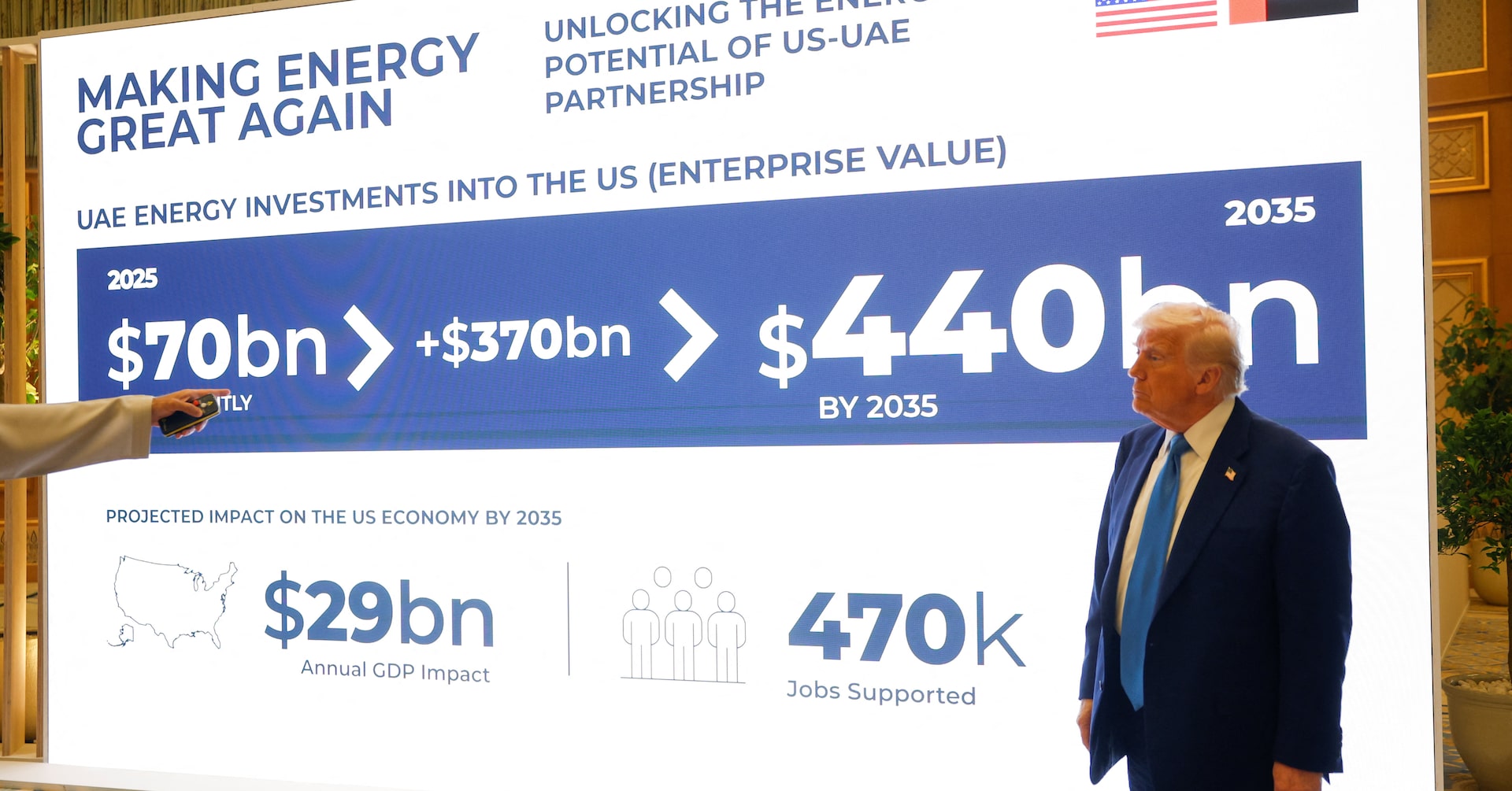

The United Arab Emirates has announced plans to increase its energy investments in the United States to a total of $440 billion over the next decade. This significant financial commitment was highlighted during a presentation by Sultan Al Jaber, the chief executive of Abu Dhabi National Oil Company (ADNOC), to U.S. President Donald Trump, who was on a Gulf tour aimed at securing major business deals.

According to Reuters, currently, the UAE’s investments in the U.S. energy sector stand at $70 billion. Sultan Al Jaber emphasized that U.S. energy firms are also expected to invest in the UAE, with new commitments of $60 billion focused on upstream oil and gas projects as well as new and unconventional opportunities.

Earlier in March, UAE officials had already pledged to a 10-year, $1.4 trillion investment framework in the United States, which aims to deepen economic ties between the two nations. This framework is designed to significantly enhance the UAE’s existing investments in various sectors, including artificial intelligence (AI), infrastructure, semiconductors, energy, and manufacturing, according to a statement from the White House.

During his visit to Abu Dhabi, Trump remarked, “We’re making great progress for the $1.4 trillion that UAE has announced it intends to spend in the United States.” He also mentioned a newly agreed-upon path for the UAE to purchase advanced AI semiconductors from American companies, which he described as a substantial contract that will generate billions of dollars in business.

In addition to these investments, XRG, the international investment arm of ADNOC, is looking to make significant investments in U.S. natural gas. Al Jaber, who also serves as XRG’s executive chairman and the minister of industry and advanced technology, pointed out that ADNOC’s interests in projects like NextDecade’s Rio Grande LNG export facility and a planned ExxonMobil hydrogen plant in Texas have been transferred to XRG. This entity, established last year, has $80 billion in assets and aims to pursue global deals in chemicals, natural gas, and renewables.

Furthermore, Mubadala Energy, part of Abu Dhabi’s second-largest sovereign wealth fund, recently signed a deal with U.S. firm Kimmeridge to acquire stakes in U.S. gas assets. This growing collaboration underscores the strong economic ties between the UAE and the United States in the energy sector.

Leave a Reply