The Federal Tax Authority has introduced a new request through the “Emirates Tax” digital platform. This initiative allows eligible family businesses to apply for treatment as joint alliances, contingent upon meeting the specific requirements outlined in Federal Decree-Law No. 47 of 2022 regarding corporate tax, as well as Ministerial Decision No. 261 of 2024 concerning...

National Bank of Fujairah Completes $100 Million Financing Agreement for Pure Cement Clinker Production Unit

The National Bank of Fujairah has successfully finalized a financing agreement worth $100 million for the construction of a clinker production unit by Pure Cement LLC. This agreement is a single currency term loan aimed at supporting the growth of the cement production sector in the region. This significant investment highlights the bank’s commitment to...

Abu Dhabi First Bank Egypt Launches New E-Banking Platform “E-Connect”

Abu Dhabi First Bank Egypt has announced the launch of “FABMISR E-Connect,” a new digital platform designed specifically for large enterprises and multinational corporations. This innovative platform demonstrates the bank’s commitment to providing advanced banking solutions that redefine customer experience. The E-Connect FABMISR platform offers a comprehensive banking experience, enabling companies to monitor and manage...

UAE and Saudi Arabia to Drive $25 Billion Sustainable Bond Issuance in 2025

Sustainable bond issuances in the Middle East are projected to reach between $18 billion and $23 billion in 2025, with the UAE and Saudi Arabia expected to contribute around 60% of this total, according to S&P Global Ratings. This significant growth reflects the increasing focus on sustainable financing in the region. Currently, sustainable bonds represent...

Tabreed Raises $700 Million Through Inaugural Green Sukuk

Abu Dhabi-based Tabreed, a prominent district cooling company, has successfully raised $700 million through its inaugural five-year green sukuk. This issuance marks the first under the company’s new $1.5 billion trust certificate issuance program. The sukuk will be listed and traded on the London Stock Exchange’s International Securities Market. The issuance saw strong institutional demand,...

CBUAE Becomes First Arab Central Bank to Adopt FX Global Code

The Central Bank of the UAE (CBUAE) has signed a Statement of Commitment to the FX Global Code, marking its position as the first central bank in the Arab world to adopt this important framework. By joining a global coalition of central banks and financial institutions, the CBUAE aims to promote integrity and best practices...

Deem Finance Secures $400 Million Debt Financing from JP Morgan

UAE lender Deem Finance, which is part of the Gargash Group, has successfully obtained an asset-backed securitization facility (ABS) of up to $400 million from J.P. Morgan. This significant financing arrangement aims to enhance the company’s balance sheet and to support its lending activities directed towards small and medium-sized enterprises (SMEs) and consumers. The deal...

Dubai Launches DIFC Hedge Funds Centre to Attract Hedge Fund Startups

Dubai is set to open a dedicated building, known as the DIFC Hedge Funds Centre, specifically designed for hedge fund startups aiming to expand into the city. This initiative reflects Dubai’s growing reputation as a hub for the hedge fund sector and is expected to result in 20 to 30 contracts being signed by the...

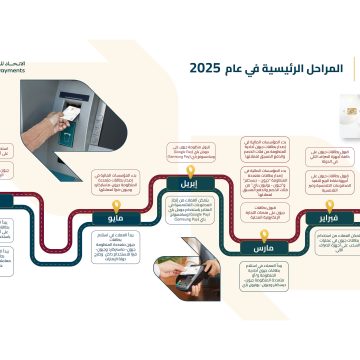

UAE Launches First Domestic Card Scheme, Jaywan

Al Etihad Payments (AEP), which is a part of the Central Bank of the UAE (CBUAE), has announced the start of Jaywan, the UAE’s first domestic card scheme. It can now be used anywhere in the world. This project fits with the UAE’s plan to become more digital and will help the country become a...

UAE Banking Sector Experiences Strong Growth Driven by Retail Lending

The UAE banking sector demonstrated robust performance in 2024, characterized by a notable increase in lending and improved cost efficiency. According to a report by Alvarez & Marsal (A&M), the sector saw double-digit growth in lending, with a remarkable 12.6 percent year-on-year (YoY) increase across the top 10 banks. This growth was heavily influenced by...