Foreign investors and institutional investors made a strong return to the local stock markets yesterday, resulting in significant gains across the indices. The market capitalization of Abu Dhabi stocks increased by more than AED 20 billion, reaching AED 3.080 trillion, while Dubai’s market capitalization grew by AED 13.51 billion, surpassing AED 1 trillion for the...

Category: Banking

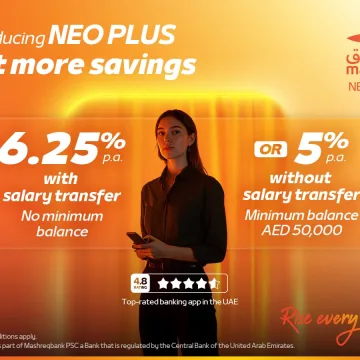

Mashreq Launches NEO PLUS Saver Account Offering 6.25% Interest Rate

Mashreq Bank has introduced a new savings account, the NEO PLUS Saver Account, which offers an impressive 6.25 percent interest rate on savings. This account is designed to be straightforward and rewarding, catering to both salaried and non-salaried customers. Salaried customers can benefit from a cashback of up to Dhs5 000 when they transfer a...

UAE Banks Expand Internationally Amid Domestic Challenges

UAE banks are increasingly looking beyond their borders as they face domestic challenges and shifting interest rates, prompting them to pursue international growth opportunities. Leading Emirati banks are strategically expanding abroad to address local difficulties, such as early government repayments and pressure on net interest margins. For instance, Abu Dhabi Islamic Bank increased its exposure...

RAKBank Mandates $300 Million Perpetual Bond Issuance

The National Bank of Ras Al Khaimah (RAKBANK) has announced a mandate for a $300 million fixed rate resettable unrated USD-denominated Regulation S Perpetual non-call 6-year additional tier 1 capital issuance, contingent upon market conditions. The bank holds ratings of Baa1 (Positive) from Moody’s and BBB+ Stable from Fitch. Several banks have been appointed to...

UAE Banks Anticipate Continued Loan Growth Despite Regional Tensions

The major banks in the UAE are expected to achieve high single-digit loan growth in the second quarter, as analysts suggest that the ongoing Iran-Israel conflict is unlikely to dampen borrowing demand. This optimistic outlook comes as increased lending is anticipated to offset slightly lower net interest margins, which, in turn, should satisfy equity investors...

Mashreq Opens Representative Office in Türkiye to Strengthen Financial Ties

Dubai, UAE; 25 June 2025: Mashreq, a leading financial institution in the MENA region, has announced the opening of its new representative office in Türkiye. This expansion emphasizes Mashreq’s commitment to supporting Turkish financial institutions and corporations, enhancing its operational presence to a total of 15 countries. As one of the largest correspondent banks in...

UAE Central Bank Suspends Bank’s Islamic Window for Six Months

The UAE Central Bank has announced a six-month suspension of a bank’s Islamic window from onboarding new customers. This decision also includes a fine exceeding Dh3.5 million ($953 632) due to the bank’s non-compliance with Sharia governance rules. An Islamic window refers to a unit within a conventional bank that allows customers to engage in...

UAE Central Bank Increases Gold Reserves by 19.3 Percent to $7.46 Billion in Q1 2025

The Central Bank of the United Arab Emirates (CBUAE) has significantly increased its gold reserves by 19.3 percent during the first quarter of 2025. This boost adds AED4.444 billion, bringing the total gold reserves to AED27.425 billion ($7.46 billion) at the end of March, up from AED22.981 billion at the end of 2024. In addition...

First Abu Dhabi Bank Joins China’s Cross-Border Payment Network as First in MENA

First Abu Dhabi Bank (FAB), recognized as one of the largest and safest financial institutions globally, has achieved a significant milestone by becoming a Direct Participant (DP) of the Cross-border Interbank Payment System (CIPS). This system serves as the official infrastructure for Renminbi (RMB) cross-border payments. This achievement highlights FAB’s commitment to digital transformation and...

Saudi Arabia Introduces New Credit Card Regulations to Enhance Customer Experience

The Saudi Central Bank (SAMA) has announced new credit card regulations aimed at reducing costs for customers while increasing transparency in the credit card sector. These updated rules will come into effect within 30 to 90 days and focus on improving the issuance and operation of credit cards. Under the new framework, credit card issuers...