RIYADH: MAGRABi Retail Group, a prominent eyewear company, has signed a deal to acquire Kuwait’s optical chain, Kefan Optics. This strategic move aims to broaden MAGRABi’s presence in the Gulf market, particularly within Kuwait’s competitive optical retail sector.

Kefan Optics is known for its professional eye care services and a loyal customer base. The acquisition is expected to increase MAGRABi’s top-line sales by 5 percent and enhance its earnings before interest, taxes, depreciation, and amortization by over 10 percent within the first year of integration. In an exclusive interview with Arab News, MAGRABi CEO Yasser Taher stated that this acquisition would elevate the company’s market share in Kuwait from 5 percent to an estimated 30 percent, positioning it as a market leader.

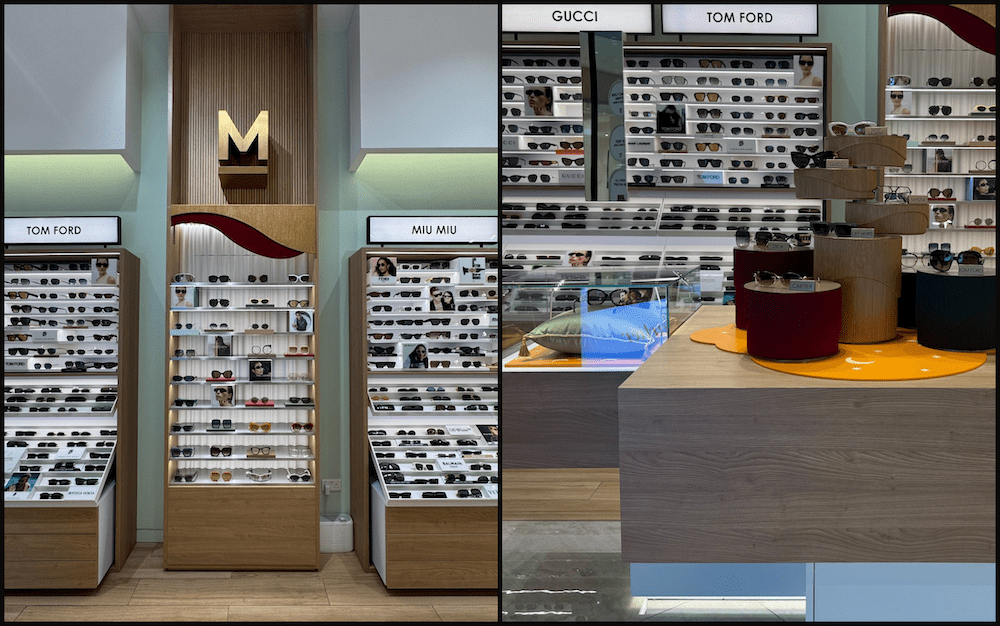

According to Arab News, Taher talked about the trustworthiness of Kefan Optics, noting that they are recognized for their professional optometry services. He mentioned, “Kefan is a highly trusted optician in Kuwait,” highlighting the fit between the two companies in terms of clientele. Rather than phasing out the Kefan brand, MAGRABi plans to preserve its legacy while enhancing operations, including a refreshed logo and redesigned stores aimed at younger demographics, particularly Gen Z.

Amin Magrabi, chair of MAGRABi Retail Group, described the deal as a significant milestone in the company’s regional expansion. He said, “This acquisition marks another defining moment in our transformation journey. We are proud to strengthen our presence in Kuwait and reinforce our leadership in a region poised for consolidation.”

Kefan Optics Chairman Wael Al-Subaih welcomed the transition, noting the brand’s long history of 47 years in the optics and lenses industry in Kuwait. He celebrated this new chapter, stating, “Today marks a significant milestone as Kefan Optics continues its journey of excellence under the Magrabi Retail Group.”

The acquisition agreement is subject to regulatory approvals from Kuwait’s Competition Authority and Saudi Arabia’s General Authority for Competition. Taher anticipates formal closing by late August or early September 2025, stating that there are several approvals required as part of the usual closing process.

Regarding financing, Taher explained that MAGRABi typically follows a hybrid model, aiming to fund 70 percent of acquisitions from banks and 30 percent from their own equity.

Looking to the future, MAGRABi is considering going public, although no formal steps have been initiated yet. Taher expressed a strong intention to become a publicly listed company, although he clarified that timelines are not immediate. He also noted that existing shareholders of Kefan Optics will have the opportunity to participate in MAGRABi’s future IPO.

MAGRABi has been pursuing growth through both organic expansion and strategic acquisitions, including the purchase of Rivoli Vision in 2024. Taher pointed out that successful mergers and acquisitions require strong operational synergies to avoid paying a high premium without improving results.

The company recorded consistent financial performance, targeting a 15-20 percent compound annual growth rate, which they have successfully achieved. In 2024, organic growth reached 14-15 percent compared to 2023, while net sales and EBITDA rose by 43 percent year over year when considering the Rivoli Vision acquisition.

MAGRABi’s mainstream brand, Doctor M, also experienced a 70 percent increase in sales, with online sales growing by 25 percent during the same period. Taher noted, “The big growth drivers remain our M&A,” underlining the importance of these acquisitions in their growth strategy.

With the Kefan Optics acquisition, MAGRABi intends to apply its retail expertise to enhance the performance of Kefan. Taher mentioned plans to modernize the brand while retaining its identity, aiming to reposition it as a premium offering in the market.

As part of its growth strategy, MAGRABi plans to invest in technology and customer experience, striving to become a leading omnichannel retailer in the Middle East. Taher stated, “The objective is to really become one of the best omnichannel retailers in the Middle East, across all categories.”

MAGRABi is also actively pursuing more acquisitions in the region. Taher confirmed, “M&A is a key pillar of our growth. We are active, and we have a pipeline that we’re working on.” With the recent acquisition and plans for an IPO, MAGRABi is positioning itself as a dominant force in the optical retail sector.

Taher concluded by expressing pride in evolving a trusted brand like Kefan Optics, stating, “It will be a very proud moment for us to take a brand that is highly trusted, like this in Kuwait, highly recognized in Kuwait, and evolve it to the next level and modernize it.”

Leave a Reply