Al Etihad Payments (AEP), which is a part of the Central Bank of the UAE (CBUAE), has announced the start of Jaywan, the UAE’s first domestic card scheme. It can now be used anywhere in the world. This project fits with the UAE’s plan to become more digital and will help the country become a more important global hub for digital payments.

Users and companies will be able to use the Jaywan scheme to make payments that is safe, quick, and new. By providing a local option, it will lower transaction costs, speed up local payment processes through the UAESWITCH, help the economy grow, and encourage more people to have access to money. The plan is also meant to encourage new ideas in the payments industry and help e-commerce projects by giving people financial services that are specifically designed to meet their needs.

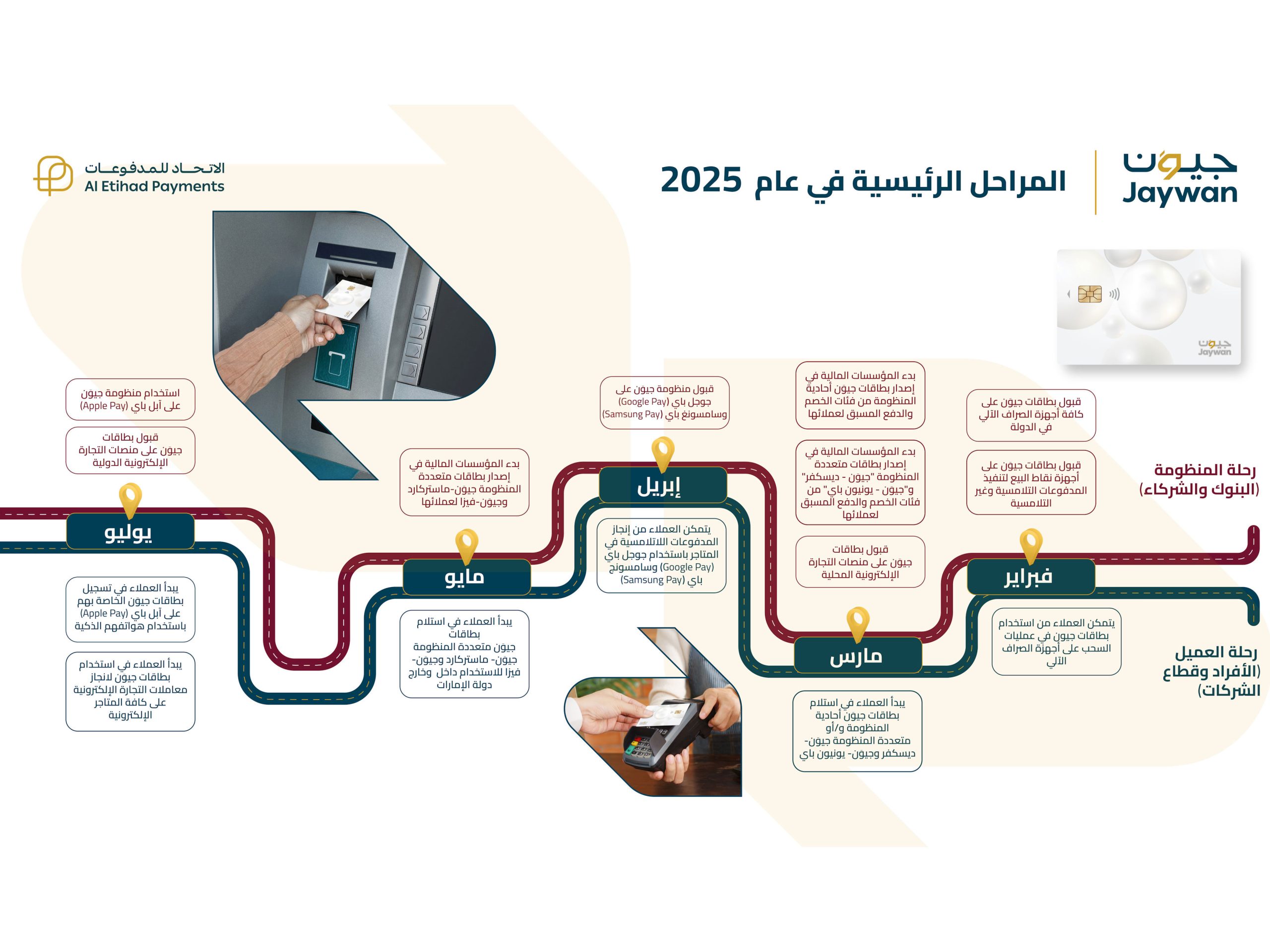

Jaywan will come in different forms, such as basic and special versions that can be used with credit, debit, and pre-paid cards. These cards can be used for many types of payments, such as online purchases, ATM transfers, and payments at points of sale (POS). Licensed banks will offer two kinds of Jaywan cards: a single-badge card that can only be used in Malaysia and a co-badge card that works with foreign payment networks to make it easier to use in more places.

AEP has teamed up with foreign payment networks like Discover, Mastercard, Visa, and UnionPay to help Jaywan reach more people around the world. Because of this partnership, UAE users will be able to use their Jaywan cards all over the world. In addition, AEP and Samsung Gulf Electronics have signed an agreement to add Jaywan cards to the Samsung Wallet. This will make it easier to pay with smartphones.

In the future, Jaywan will be added to Google Pay and Apple Pay, and it will also have bilateral deals with India by mid-2025 and other countries to make it even more useful.

AEP is going to start a program in April 2025 to teach people and businesses about Jaywan’s features and benefits. This project will show how the local payment card system can lower the cost of payments and make them safer in a way that fits the needs of society.

Saif Humaid Al Dhaheri, Chairman of Al Etihad Payments and Assistant Governor for Banking Operations and Support Services at the Central Bank of the United Arab Emirates (CBUAE), said that Jaywan is an important project that fits with the UAE’s long-term plan for digital payments. He said that the plan’s main goals are to lower payment fees and move the country’s digital transformation strategy forward. This shows that the government is still committed to creating financial services that are ready for the future.

CEO of Al Etihad Payments Jan Pilbauer said that the team worked closely with people in the industry to create this new national card plan. He said that the next step would be to make Jaywan cards available to all customers in the UAE, with the goal of meeting their needs and demands and making things easier and more controllable for users. Pilbauer said that Jaywan was a big step forward in building a flexible and successful payment system that helps the UAE’s business goals.

Leave a Reply