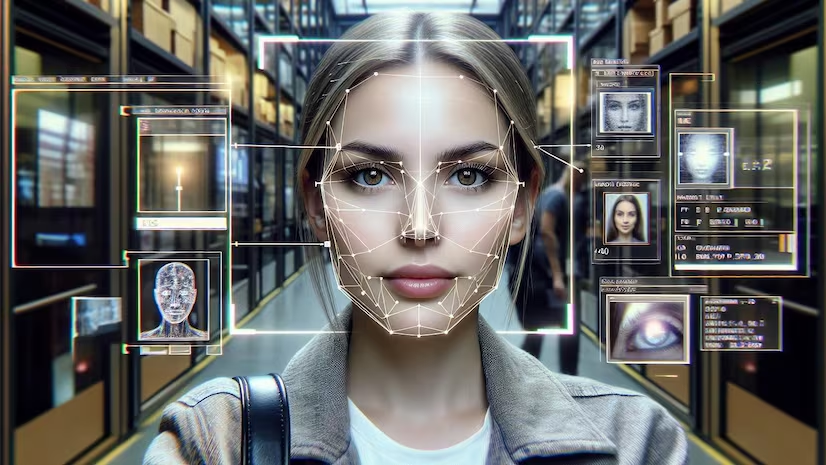

Residents of the UAE looking to purchase life insurance can now bypass traditional medical tests with the launch of an innovative AI-powered face scanning tool. This technology, introduced by Sukoon Insurance, allows applicants to measure key health indicators such as heart rate, blood pressure, and respiration rate through videoconferencing. This advancement aims to streamline the application process, making it more convenient and efficient for users.

Emmanuel Deschamps, executive vice president and head of individual life and workplace saving at Sukoon, explained that the initiative sets specific age bands and sum assured limits for policies to qualify for the elimination of medical tests. He emphasized that the company plans to gradually expand the exemptions as this approach is novel in the market, indicating that the solution is currently tailored exclusively for individual life insurance policies.

The UAE’s commitment to artificial intelligence is evident as both public and private sectors aggressively adopt this technology. A study by Trends Research and Advisory projects that the UAE’s AI market could reach $46.33 billion by 2030, driven by initiatives like the National AI Strategy 2031 and the establishment of advanced innovation centers. Deschamps highlighted that Sukoon’s approach not only covers the costs of medical tests, resulting in substantial savings for customers, but also allows them to complete the insurance application process from virtually anywhere.

In 2024, Sukoon Insurance reported gross written premiums of Dh5.84 billion and received ratings of A from Standard and Poor’s and A2 from Moody’s. Deschamps noted that the integration of AI within their videoconferencing tool showcases the company’s digital focus, aimed at enhancing flexibility and convenience for its customers.

Leave a Reply